How to Read an Apportionment, Part I: Structure and Time-Based Controls

You found an apportionment. Now what?

1. What is an apportionment?

2. How to Read an Apportionment, Part I: Structure and Time-Based Controls

3. How to Read an Apportionment, Part II: Program Controls and Legal Weight

In our first post, we explained what apportionments are and why they matter. Now let's learn how to read one. Apportionments follow a standard structure defined by OMB Circular A-11. Once you understand the layout, you can read any apportionment—regardless of agency or account.

The 60-Second Version

The Two Main Sections:

| Section | What It Shows | Key Question |

|---|---|---|

| Budgetary Resources (top half, 1XXX lines) | Where the money comes from | "How much is available?" |

| Application of Budgetary Resources (bottom half, 6XXX lines) | How it's allocated | "How much can be obligated, and when?" |

The Key Insight:

Just because resources are available doesn't mean they're apportioned. The gap between total resources and apportioned amounts tells you whether OMB is holding anything back.

Check out our quick visual explainer.

Where to find them:

- MAX.gov Apportionment Portal - Official source

- OpenOMB.org - Searchable archive with historical data

Authoritative Document:

The Header: Identifying the Account

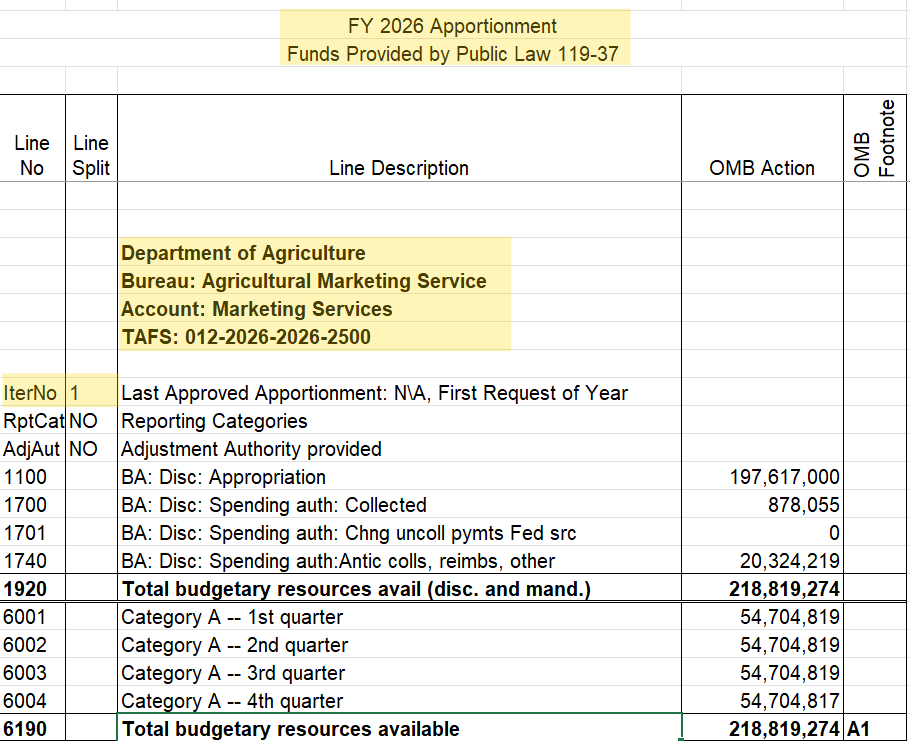

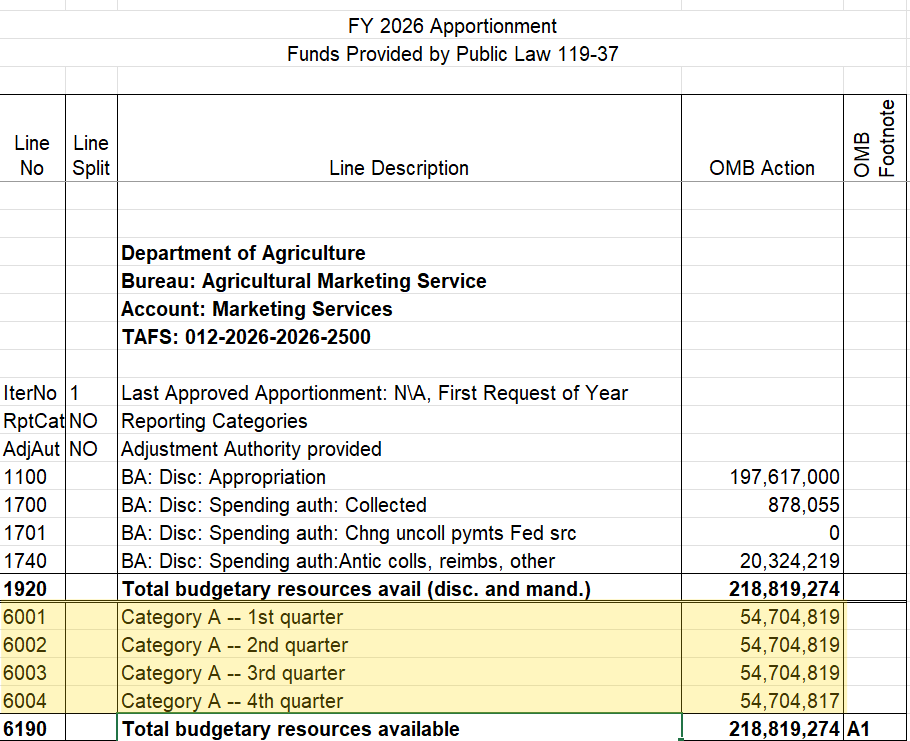

Every apportionment begins with identifying information. Using our USDA Marketing Services example from Part I:

Source: OMB | OpenOMB.org

- Fiscal Year: 2026

- Legal Source: P.L. 119-37 (the appropriations act)

- Agency: Department of Agriculture

- Bureau: Agricultural Marketing Service

- Account Title: Marketing Services

- TAFS: 012-2026-2026-2500 (the Treasury Account Fund Symbol—see our TAFS explainer)

- Iteration: 1 (first version this fiscal year)

Why Version Numbers Matter

A single account might have 10+ versions in a fiscal year. Each continuing resolution, supplemental appropriation, or policy change triggers a new version.

If you're looking at "Iteration 7," that means six reapportionments already happened. Always verify you're looking at the current version—an October apportionment may be completely superseded by December.

The Two Halves That Balance

Every apportionment has two sections that must equal each other:

Section 1: Budgetary Resources (The Top Half)

The top section answers: "Where does the money come from?"

This tallies everything the account has available—not just new appropriations, but all sources of budgetary resources.

Common line numbers:

| Line | What It Shows |

|---|---|

| 1100 | Appropriations (new budget authority) |

| 1700-1740 | Spending authority from fees/collections |

| 1920 | Total budgetary resources |

In our USDA example:

- Line 1100: $197.6 million appropriation

- Lines 1700-1740: ~$21 million in fees

- Line 1920: $218,819,274 total

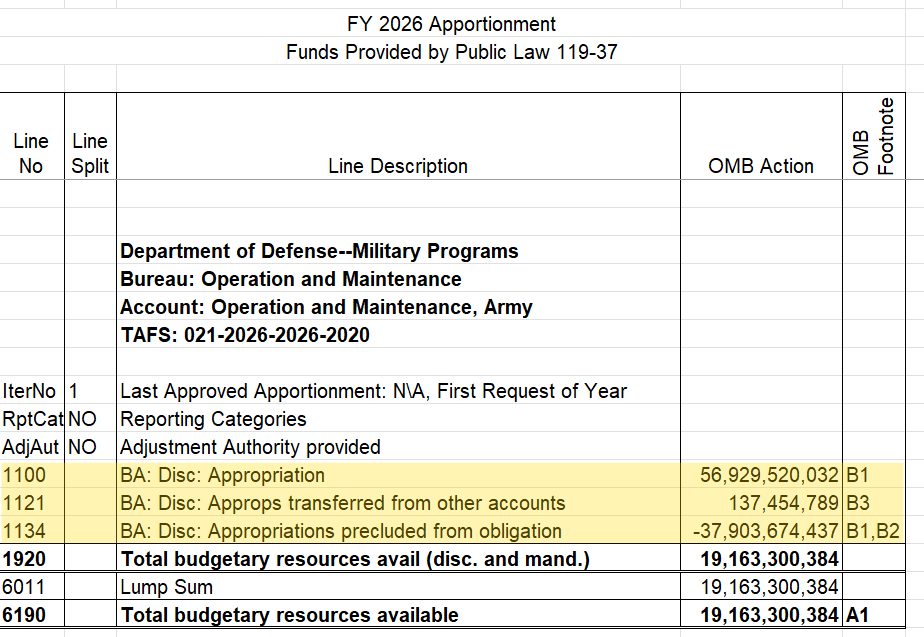

Let's cover some more lines in the top half that can affect the total amount of funding available. Here's another apportionment- Army's Operation and Maintenance account:

Source: OMB | OpenOMB.org

Line 1120-1121: Transfers

Congress has provided some accounts with the authority to transfer funds in and out of the account. OMB records these transfers on lines 1120 (transfers out) and 1121 (transfers in). Here, $137,454,789 transferred in from another account (line 1121). These transferred amounts don't become available until OMB apportions the funding, and that's what's happening in this example.

Line 1134: Appropriations precluded from obligation

During a Continuing Resolution (CR), OMB calculates the number of days in the CR and divides by the number of days in the year to determine how much money an agency has available during the CR period.

Let's check the math in the Army, Operations and Maintenance apportionment:

| Line | What | Amount |

|---|---|---|

| 1100 | Prior year appropriation in CR | $56,929,520,032 |

| Prorata percentage from CR | x 33.42% | |

| = | $19,025,845,595 | |

| + | Transfers In | $137,454,789 |

| 1920 | Total | $19,163,300,384 |

The total on line 1920 is right. How did OMB get the amount on Line 1134?

| Line | What | Amount |

|---|---|---|

| 1100 | Prior year appropriation in CR | $56,929,520,032 |

| - | Prorated funding available (33.42%) | $19,025,845,595 |

| 1134 | Appropriations precluded from obligation | $37,903,674,437 |

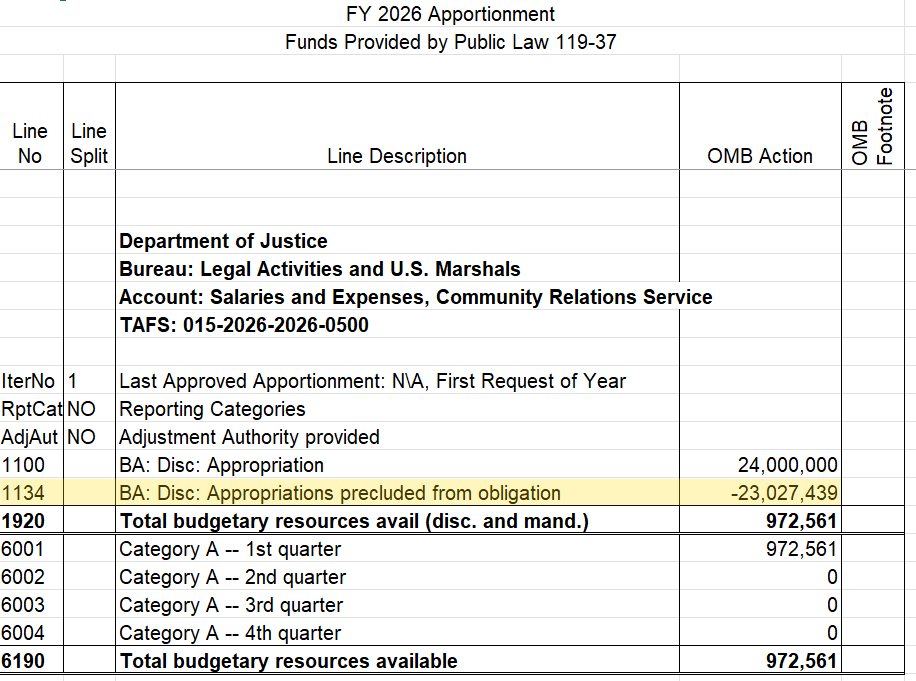

Line 1134 is a line to watch. In certain cases, if the House or Senate eliminates funding for an account, OMB might increase the amount withheld on line 1134 to allow for a final funding decision to play out. Take this example for Department of Justice's Community Relations Service:

Source: OMB | OpenOMB.org

Let's run the numbers.

| Line | What | Amount |

|---|---|---|

| 1100 | Prior year appropriation in CR | $24,000,000 |

| Prorata percentage from CR | x 33.42% | |

| = | $8,020,800 |

Or another way:

| Line | What | Amount |

|---|---|---|

| 1920 | Total budgetary resources available | $972,561 |

| ÷ | Line 1100 | $24,000,000 |

| = | 4.05% |

Something is going on here! You'd expect ~$8 million to be available if this account was getting the automatic apportionment in the CR. Instead there's just under $1 million. It's also ~4 percent instead of ~33 percent. The administration proposed eliminating this account and the FY 2026 House Commerce, Justice, Science bill did not provide funding. The Senate bill, however, provided funding. This is policy happening in real-time—visible in the apportionment if you know where to look.

Section 2: Application of Budgetary Resources (The Bottom Half)

The bottom section answers: "How can the money be used, and when?"

This is where apportionment happens—where OMB divides total resources into amounts available by time period.

Line 6190 (Total Application) must equal Line 1920 (Total Budgetary Resources).

Every dollar is accounted for. The two halves are talking about the same money—just from different angles.

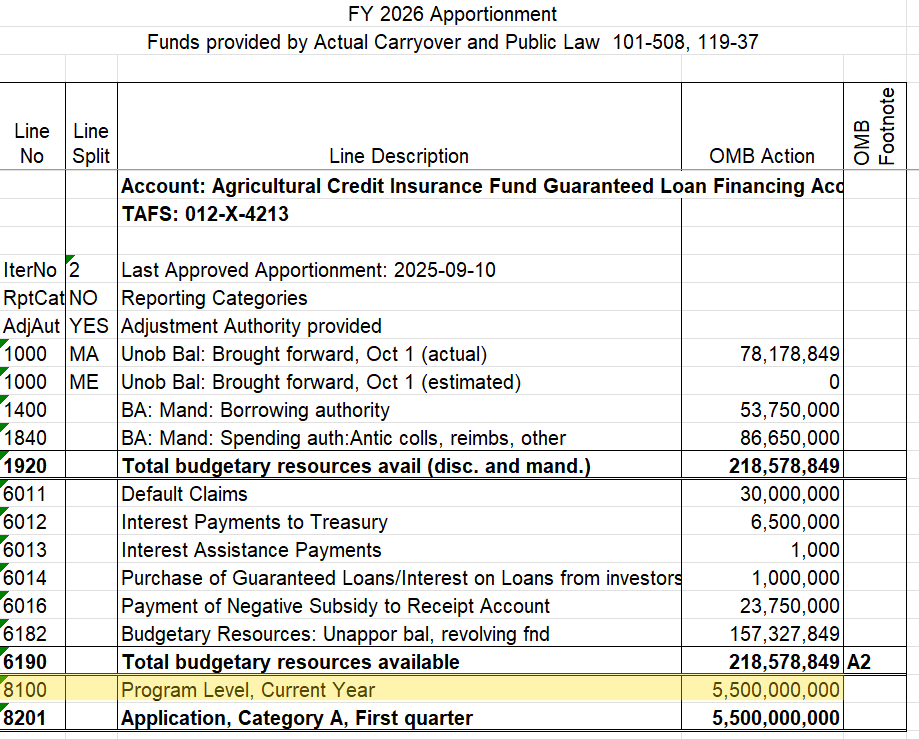

Section 3: Guaranteed Loan Levels and Applications (The Very Bottom)

I want to touch briefly on another section that only appears in certain loan programs. Here is USDA's Agricultural Credit Insurance Fund Guaranteed Loan Financing Account:

Source: OMB | OpenOMB.org

We'll cover credit programs in another post, but know that loan programs

work differently than budget-based programs in the federal accounting space. While the account receives budget authority, loan programs don't obligate the full loan amount—they obligate a calculated subsidy cost. These 8XXX lines limit the total loan volume the agency can commit to.

Time-Based Apportionments: Category A

Most apportionments control when funds can be obligated. This is called Category A—apportionment by time period.

Example 1: Even Quarterly Distribution

The simplest pattern: divide by four.

Source: OMB | OpenOMB.org

Notice Q4 is $2 less than the other quarters. That's not a typo—it's OMB ensuring the math balances exactly.

This is a clean apportionment: all funds released, spread evenly across the year. OMB uses this type of structure when the obligational profile is fairly consistent throughout the fiscal year. But even then, it might be worth some scrutiny. For this account, this is the first time in recent years that the administration has apportioned these funds by quarter. Previous apportionments made the funds available in one lump sum at the beginning of the fiscal year.

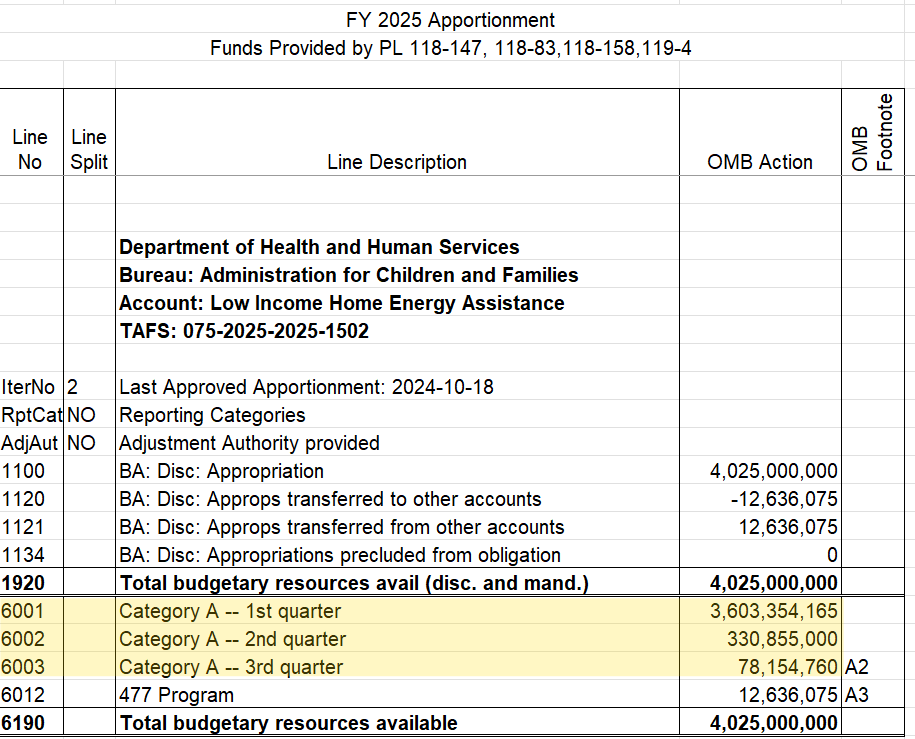

Example 2: Uneven Quarterly Distribution

Not all programs spend evenly. Some are seasonal.

Source: OMB | OpenOMB.org

| Line | Quarter | Amount |

|---|---|---|

| 6001 | Q1 (Oct-Dec) | $3,603,354,165 |

| 6002 | Q2 (Jan-Mar) | $330,855,000 |

| 6003 | Q3 (Apr-Jun) | $78,154,760 |

| 6012 | 477 Program | $12,636,075 |

| 6190 | Total | $4,025,000,000 |

Why would Q1 get more? Program timing. This is the apportionment for the Low Income Home Energy Assistance program at HHS. These funds are used to pay the heating and cooling bills of families with low-incomes. For years, this account has been front-loaded into the first quarter, so that states can make grants during the heating season, fiscal quarters 1 and 2.

Once funds are made available, they stay available throughout the rest of the fiscal year. The apportionment reflects when the agency actually needs to obligate funds.

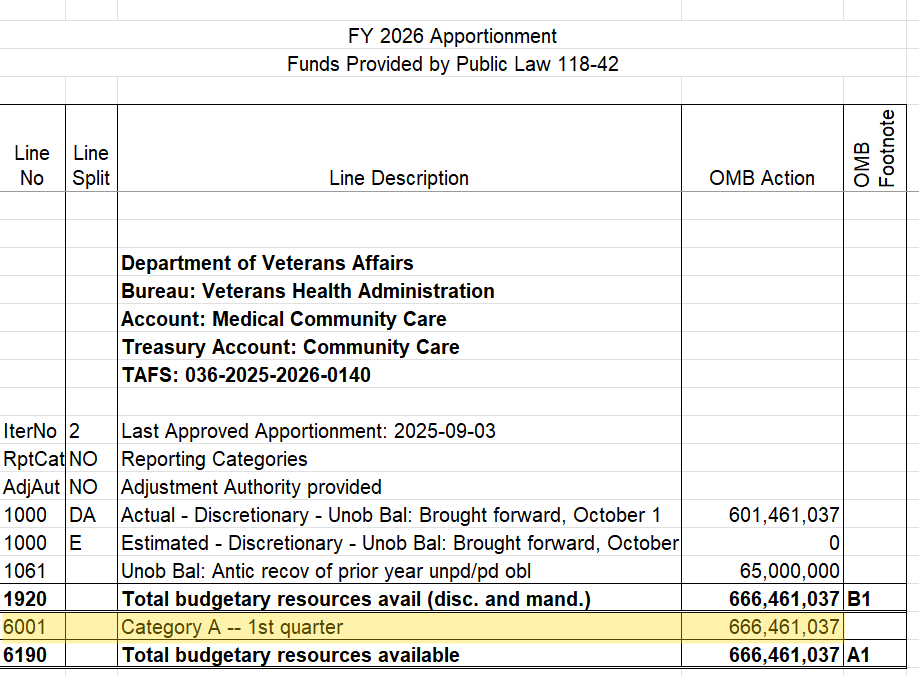

Example 3: Lump Sum (All at Once)

Some accounts get their full apportionment in Q1.

Source: OMB | OpenOMB.org

| Line | Quarter | Amount |

|---|---|---|

| 6001 | Q1 (Oct-Dec) | $666,461,037 |

| 6190 | Total | $666,461,037 |

This is VA's Community Care account. It provides medical care to Veterans outside of VA facilities. Medical bills come in when the veteran needs the care, not on a fixed schedule. So to account for this, OMB makes the full amount available in the first quarter.

You're probably asking yourself, what happens in quarters 2-4? Are they out of money? These lines are cumulative. When funds are made available in a category A line, they're available in that quarter and each following quarter for the rest of the fiscal year.

This happens when:

- The program needs to obligate quickly (disaster relief, time-sensitive grants)

- Multi-year funds that don't need quarterly pacing

- Accounts where the obligational flows don't follow a regular pattern

- Small accounts where quarterly limits would be administratively burdensome

Sometimes you'll see the line description written differently- "Lump Sum" as in the Army, Operations and Maintenance example above.

Future Period Apportionments: Category C

For multi-year and no-year appropriations, OMB can control not just which quarter but which fiscal year.

This is Category C—apportionment to future periods.

How It Works

A 5-year appropriation might be apportioned:

| Fiscal Year | Amount | Available Now? |

|---|---|---|

| FY2026 | $100,000,000 | Yes |

| FY2027 | $100,000,000 | No (Category C) |

| FY2028 | $100,000,000 | No (Category C) |

| FY2029 | $100,000,000 | No (Category C) |

| FY2030 | $100,000,000 | No (Category C) |

Even though Congress appropriated $500M available over 5 years, the agency can only obligate $100M this year. The rest is held for future periods.

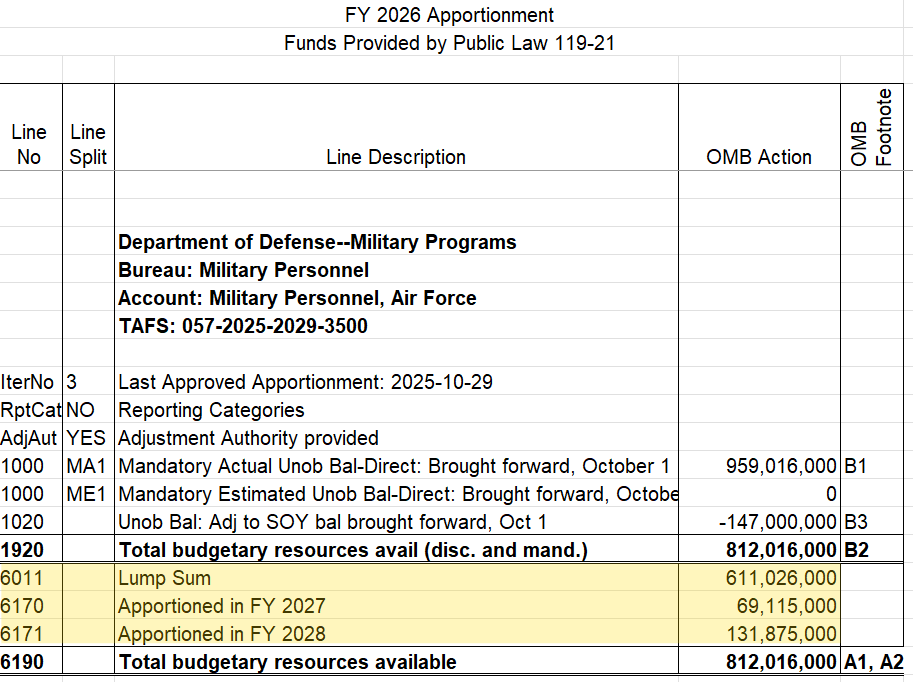

Here's a real example. In the One Big Beautiful Bill Act (OBBBA), Congress provided multi-year funding to the Department of Defense for military personnel. The funds became available in FY 2025 and expire in FY 2029. Congress meant for these funds to be spent over multiple years. Below is the Military Personnel account for the Air Force from OBBBA.

Source: OMB | OpenOMB.org

| Fiscal Year | Amount | Available Now? |

|---|---|---|

| FY2026 | $611,026,000 | Yes |

| FY2027 | $69,115,000 | No (Category C) |

| FY2028 | $131,875,000 | No (Category C) |

OMB has made most of the funding available this year, but has reserved some funding to be available in each of fiscal years 2027 and 2028.

Why OMB Uses Category C

- Smooths spending over multi-year projects

- Prevents front-loading of long-term funding

- Aligns with realistic execution timelines

- Preserves flexibility for future priorities

Unapportioned Balances: The Red Flag Zone

Not all budgetary resources get apportioned. When you see an unapportioned balance, pay attention.

What Unapportioned Means

| Reason | Concerning? |

|---|---|

| Timing - Funds not yet needed (normal for multi-year) | No |

| Reserve - Held for contingencies | Usually no |

| Deferral - Temporarily withheld, reported to Congress | Legal, but watch it |

| Impoundment - Withheld without following ICA procedures | Yes - potentially illegal |

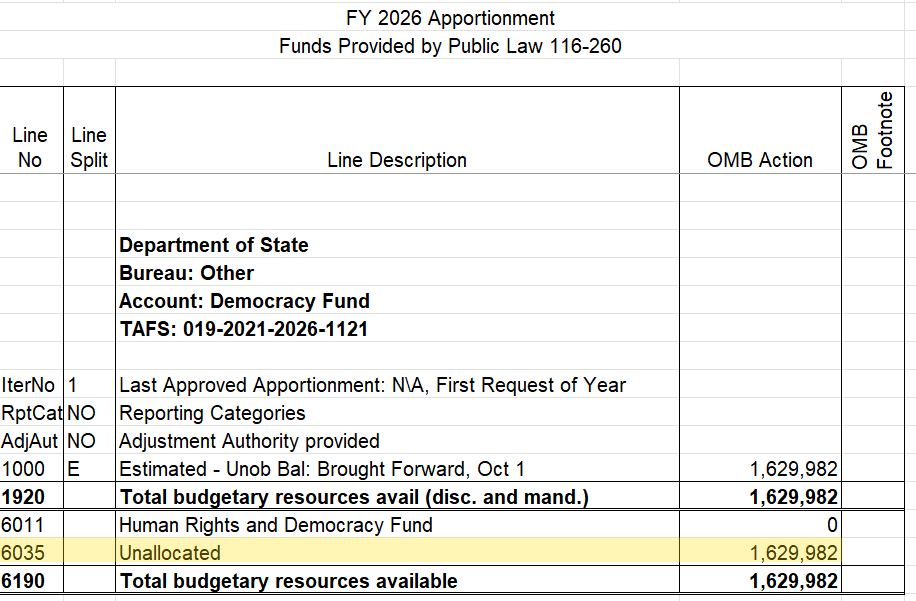

Example: Unapportioned Balance

Source: OMB | OpenOMB.org

| Line | Description | Amount |

|---|---|---|

| 1920 | Total budgetary resources | $1,629,982 |

| 6011 | Human Rights and Democracy Fund | $0 |

| 6035 | Unallocated | $1,629,982 |

| 1920 | Total budgetary resources | $1,629,982 |

In this example, the top and bottom half balance, but no funds can be obligated. Why? All of the funds in this account are in the unallocated line.

From the TAFS (019-2021-2026-1121), we know fiscal year 2026 is the last year the funds in this account are available. It might be that OMB and the administration are waiting for a plan for these funds, it could be that the funds aren't needed, or it could be that the administration is planning on putting these funds in a rescissions proposal. Either way, it's worth questioning - these funds are not available for the agency to use and while you can't discern the reason from the apportionment alone, there's a policy reason and the apportionment is the clue.

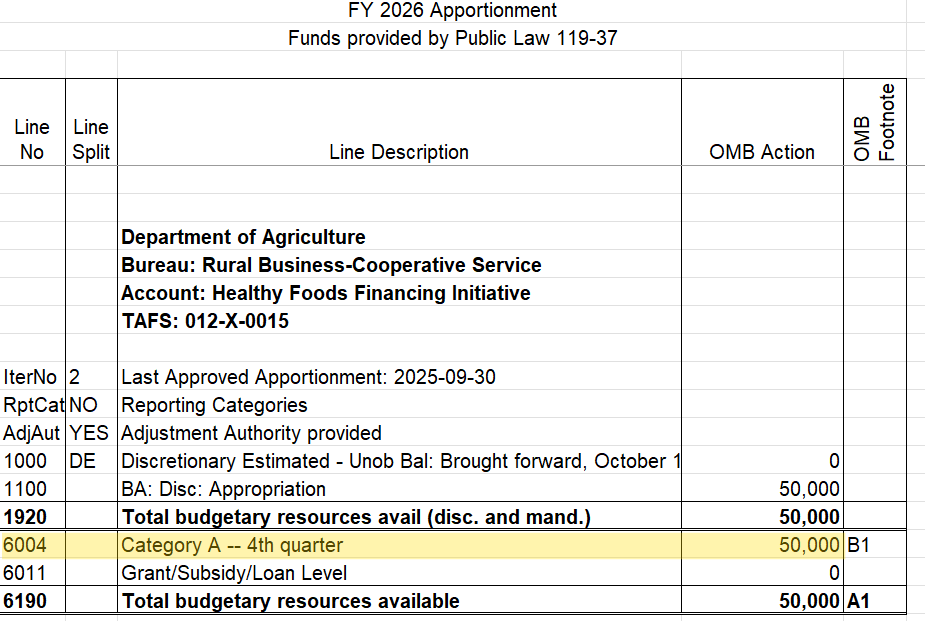

A Weird One: Healthy Foods Financing Initiative

At first glance, this apportionment for USDA's Healthy Foods Financing Initiative looks good. The top and bottom halves balance, and there's no "Unallocated" line. Take a closer look:

Source: OMB | OpenOMB.org

| Line | Description | Amount |

|---|---|---|

| 6004 | Category A -- 4th quarter | $50,000 |

All of the funds are apportioned, but they do not become available until the last quarter of the fiscal year. These funds are not available until July 1, 2026. Between now and July 1, no funds are apportioned. This is intentional, but you can't figure out the reason from the apportionment alone. It could be that there is a large loan that's scheduled to close between July 1 and September 30. It could also be that the administration is planning on proposing these funds for rescission at some point before July. You can't figure out the reason why this apportionment is structured the way it is, but it's a clue to inquire further.

Quick Reference: Reading Any Apportionment

When you open an apportionment, answer these questions in order:

| Question | Where to Look |

|---|---|

| What account is this? | Header (TAFS, account title) |

| Is this the current version? | Iteration number, effective date |

| How much is available? | Line 1920 (Total budgetary resources) |

| How much can be obligated? | Lines 6001-6099 (Apportioned amounts) |

| Is anything held back? | Unapportioned balance (if present) |

| When can it be spent? | Quarterly breakdown (6001-6004) |

What's Next

Now you understand the document's structure and how OMB controls the timing of federal spending through Category A and C apportionments.

But timing isn't the only lever. In Part II, we'll cover Category B—how OMB controls which programs get funding—plus the footnote system and what happens when agencies exceed their limits.

BlazingStar Analytics is building real-time budget execution tracking that connects appropriations, apportionments, and SF-133 reports. Get early access to our platform, launching Spring 2026.